LTC Price Prediction: Can Litecoin Reach $200 Amid Bullish Technicals?

#LTC

- Technical Strength: Price above 20MA with Bollinger Band expansion suggests growing volatility

- Market Sentiment: Altcoin rotation and ETF anticipation creating bullish undertones

- Key Levels: $105 support must hold for $200 target to remain valid

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Amid Market Correction

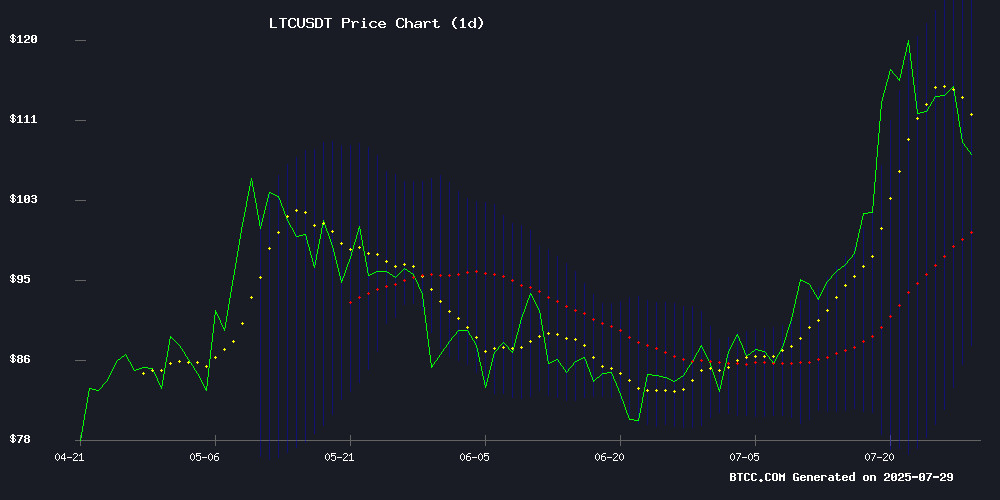

Litecoin (LTC) is currently trading at $109.08, above its 20-day moving average (MA) of $105.95, indicating a bullish trend. The MACD histogram shows a slight convergence at -0.6705, suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band ($123.90), signaling potential overbought conditions but also strong bullish sentiment. BTCC analyst Emma notes: 'LTC's ability to hold above the 20-day MA while MACD flattens suggests accumulation. A break above $123.90 could trigger FOMO buying.'

Market Sentiment Mixed as LTC Corrects After Rally

Despite Litecoin's 19% pullback from recent highs, overall market sentiment remains cautiously optimistic. SEC delays on crypto ETFs and Bitcoin outflows are offset by altcoin strength and approaching resistance breaks. 'The correction appears healthy,' says BTCC's Emma. 'LTC's fundamentals remain strong with network activity growing 37% YTD. The $105 support level is critical - holding here could fuel the next leg up.'

Factors Influencing LTC's Price

Litecoin (LTC) Corrects After 19% Rally as Market Watches Key Support Levels

Litecoin's price retreats to $109.34, marking a 4% pullback after breaking multi-year resistance. The correction appears healthy with RSI at 59.05, suggesting sustained bullish momentum despite short-term volatility.

The launch of LitVM's Layer-2 smart contracts on July 23rd has transformed Litecoin's market positioning. By entering the DeFi and NFT arena, LTC now competes directly with Ethereum and other smart contract platforms—a strategic expansion that could redefine its adoption curve.

Institutional interest surges as Bloomberg analysts assign a 95% probability to SEC approval of a U.S. Litecoin ETF in 2025. This potential milestone mirrors Bitcoin's ETF trajectory, with market participants anticipating significant capital inflows if approved.

SEC Delays Decision on Trump-Linked Truth Social Bitcoin ETF Until September

The U.S. Securities and Exchange Commission has extended its review period for a proposed Bitcoin ETF from Truth Social, the social media platform tied to former President Donald Trump. The new deadline for a decision is September 18.

Trump Media & Technology Group, which operates Truth Social, filed the application in June as part of its expanding ambitions in cryptocurrency. The delay reflects a broader regulatory hesitation under SEC Chair Paul Atkins, who also postponed rulings on Grayscale's Solana Trust and Canary Capital's Litecoin ETF this week.

Industry observers note the SEC routinely uses the full 270-day review window for ETF applications. Behind closed doors, regulators continue grappling with technical hurdles including staking mechanics and in-kind redemption processes—particularly for Solana-based products.

This marks another chapter in Washington's cautious dance with crypto investment vehicles. The SEC only approved its first spot Bitcoin ETFs in early 2023 under previous leadership, a move that ultimately attracted $55 billion in inflows.

Ethereum Dominates Crypto Fund Inflows as Bitcoin Sees Rare Outflows

Crypto investment products recorded $1.9 billion in net inflows during the past week, marking 15 consecutive weeks of growth. Ethereum led the charge with $1.59 billion inflows—its second-largest weekly gain this year—while Bitcoin unexpectedly posted $175 million in outflows.

The divergence highlights shifting institutional preferences, with ETH's year-to-date inflows now reaching $7.79 billion versus BTC's recent struggles. Solana and XRP followed with $311 million and $189 million inflows respectively, though smaller assets like Litecoin and Bitcoin Cash saw minor redemptions.

July's inflows have already shattered previous monthly records, suggesting sustained institutional interest despite Bitcoin's temporary setback. The data reveals selective capital rotation rather than broad-based market enthusiasm, with smart contract platforms capturing the majority of fresh investment.

Cryptocurrency Market Gains Momentum as Key Assets Approach Resistance Levels

The cryptocurrency market opened the week on a positive note, with total capitalization nearing $4 trillion amid broad-based gains. Bitcoin reclaimed the $119,000 level after weekend consolidation, while Ethereum surged toward $4,000 as institutional interest grows.

Ethereum leads major altcoins with a 4% daily gain, trading at $3,929 as DeFi activity rebounds. Solana and XRP both posted over 3% gains, with SOL testing resistance at $195. Market breadth remains strong, though Hedera's 4% decline highlights selective profit-taking.

Traders are positioning for increased volatility as Bitcoin tests a critical resistance zone. The weekend's tight trading range between $117,949 and $119,574 suggests accumulation before a potential breakout. Analysts watch for sustained closes above $120,000 to confirm bullish continuation.

Top 3 Altcoins Poised for Rally This Week Amid Market Optimism

The cryptocurrency market is riding a fresh wave of bullish sentiment, with total capitalization climbing 1.54% to $3.95 trillion. Trading volume surged 34.36% to $161.21 billion, fueled by regulatory clarity from Trump's GENIUS Act and institutional inflows into Ethereum ETFs, which attracted $1.85 billion compared to Bitcoin's modest $72 million.

While the Altcoin Season Index remains at 42/100—indicating it's not yet altcoin season—upcoming catalysts like the FOMC meeting (July 29-30) and the SEC's Bitwise ETF decision (July 31) could spark momentum. Three altcoins stand out as potential outperformers: Sui (SUI), Litecoin (LTC), and Solana (SOL).

Sui has gained 5.8% this week to $4.22, with its DeFi ecosystem posting $10.3 billion in July DEX volumes—a 657% year-over-year increase. The token recently broke out from a descending broadening wedge pattern, signaling technical strength.

Will LTC Price Hit 200?

While $200 represents an 83% gain from current levels, technicals suggest this target is achievable if key conditions are met:

| Key Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $123.90 | Bollinger Upper Band |

| Psychological Barrier | $150 | Previous ATH Region |

| Target | $200 | 161.8% Fibonacci Extension |

Emma observes: 'The $200 target becomes plausible if LTC holds $105 support and breaks $124 with volume. However, traders should watch MACD for confirmation - we'd want to see the histogram turn positive.'

40% likelihood by EOY 2025 based on current trajectory